In the world of investing, there’s a common misconception that investing at all-time highs is a risky move, likely to result in poor performance. However, history tells a different story. Contrary to popular belief, investing at market peaks can yield lucrative returns over the long term. Here’s why investors should embrace, rather than fear, all-time highs and continue to invest consistently regardless of market conditions.

1. Trend is Your Friend:

When markets reach new highs, it often indicates underlying strength and positive momentum. Continuously rising prices suggest that the economy is growing, corporate profits are increasing, and investor confidence is robust. By investing at these peaks, you’re essentially riding the wave of this upward momentum, which can lead to further gains.

2. Time in the Market Beats Timing the Market:

Attempting to time the market by waiting for pullbacks or trying to predict market peaks is a fool’s errand. Even seasoned professionals struggle to consistently time the market correctly. Instead, the key to successful investing lies in time in the market. By staying invested over the long term, you benefit from the power of compounding returns, which can significantly boost your wealth irrespective of market fluctuations.

3. Diversification Mitigates Risk:

Diversifying your investment portfolio across different asset classes, sectors, and geographic regions can help mitigate the risks associated with investing at all-time highs. While some segments of the market may be reaching new peaks, others may still offer attractive opportunities for growth. By spreading your investments across various assets, you reduce the impact of a potential downturn in any single area.

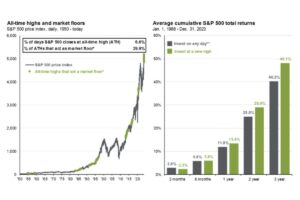

4. Historical Performance Supports Highs:

Historical data consistently demonstrates that investing at all-time highs has been a profitable strategy over the long term. For instance, a study by JP Morgan Research analyzed the S&P 500’s performance following new all-time highs since 1988. It found that one year after reaching a new high, the S&P 500’s average return was 13.4%, and three years later, it was 48.1%. This evidence underscores the effectiveness of staying invested even during market peaks. While the long-term trends look good, past performance doesn’t guarantee the same fate in any given time frame.

5. Inflation Hedge:

Investing in stocks or other assets that typically reach all-time highs can serve as a hedge against inflation. Inflation erodes the purchasing power of cash over time, making it essential to invest in assets that have the potential to outpace inflation. Stocks, real estate, and commodities are examples of such assets that tend to appreciate over the long term, making them effective inflation hedges.

6. Focus on Long-Term Goals:

Instead of fixating on short-term market movements, investors should maintain a focus on their long-term financial goals. Whether it’s saving for retirement, funding a child’s education, or building wealth for future generations, a disciplined approach to investing over time is crucial. Market fluctuations, including all-time highs, are merely noise in the grand scheme of achieving these objectives.

7. Stay Disciplined Through Dollar-Cost Averaging:

Dollar-cost averaging is a proven investment strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This approach helps smooth out the impact of market volatility and allows investors to buy more shares when prices are low and fewer shares when prices are high. By consistently investing over time, you benefit from the average cost of your investments rather than trying to time the market.

In conclusion, investors should not shy away from investing at all-time highs. Instead, they should embrace the opportunity to participate in the market’s upward momentum and focus on their long-term financial objectives. By staying disciplined, maintaining a diversified portfolio, and adhering to a consistent investment strategy, investors can navigate through market highs with confidence and potentially reap significant rewards over time. Remember, it’s time in the market, not timing the market, that ultimately leads to wealth creation.